In today’s fast-paced business environment, the way organizations handle their financial documentation has become increasingly important. Companies are recognizing the need to streamline processes that involve tracking expenditures, ensuring that they are not only productive but also reduce the risk of errors. With the advancement of technology and innovative solutions, a promising new era has emerged, where outdated methods are replaced by smart approaches that foster clarity and performance.

As enterprises seek to enhance their workflows, understanding the potential for improvement has never been more crucial. By adopting new methodologies, businesses can significantly reduce the time spent on tedious tasks while improving the reliability of their financial data. This shift not only mitigates the likelihood of discrepancies but also empowers employees to focus on more strategic initiatives that can drive growth and success.

Ultimately, this evolution in handling financial information opens doors to more accurate analysis and informed decision-making. As organizations strive to stay ahead of the curve, embracing these advancements becomes imperative in achieving sustainable prosperity in the competitive landscape. The journey towards an optimized approach is one filled with opportunities for both innovation and precision.

Modern Challenges in Expense Reporting

In today’s fast-paced business environment, organizations face numerous obstacles when it comes to managing financial documentation. The complexities of tracking, validating, and reconciling expenditures can hinder productivity and lead to inaccuracies. These hurdles necessitate innovative solutions to streamline the process and enhance overall accountability.

Technological Constraints

One significant challenge arises from the reliance on outdated systems that lack integration with contemporary technology. Many organizations still utilize manual methods, which increases the likelihood of errors and delays. A lack of automation can stifle productivity, as employees spend excessive time on repetitive tasks rather than focusing on strategic initiatives.

Compliance and Policy Adherence

Another pressing issue is ensuring compliance with rapidly evolving regulations and internal policies. With diverse legal landscapes across regions, organizations must consistently update and communicate guidelines to their teams. Failure to adhere to such regulations can result in severe financial penalties and damage to reputation.

| Challenge | Description | Possible Solutions |

|---|---|---|

| Outdated Systems | Reliance on manual processes leading to errors. | Implement automated tools for tracking. |

| Compliance Issues | Difficulties in keeping up with regulations. | Regular training and updates for staff. |

| Lack of Transparency | Challenges in visibility over expenditures. | Utilize centralized platforms for better oversight. |

Benefits of Automation in Financial Processes

The integration of technology into financial workflows brings numerous advantages that enhance performance and precision. By streamlining various tasks, organizations can achieve improved accuracy in their operations while significantly reducing the time required for processing. The utilization of automated systems ensures that data is consistently entered and analyzed, which minimizes human error and enhances overall reliability.

Enhanced Efficiency

One of the primary advantages of automation in financial tasks is the remarkable increase in productivity. Processes that previously took hours or days can now be completed in a fraction of the time. This acceleration not only frees up valuable resources but also allows personnel to focus on more strategic initiatives rather than mundane administrative duties.

Improved Compliance and Accuracy

Automated financial systems help ensure compliance with regulations by implementing consistent procedures. This systematic approach enhances data integrity and reduces discrepancies, leading to more trustworthy outcomes. Businesses can easily generate accurate reports, track transactions, and maintain records in a seamless manner.

| Advantage | Description |

|---|---|

| Time-saving | Automation significantly reduces the time required to complete tasks. |

| Cost-effectiveness | Fewer resources are needed for manual entry and oversight, lowering overall expenditures. |

| Data Accuracy | Minimized human errors result in more reliable financial information. |

| Real-time Monitoring | Immediate insight into financial trends and anomalies is achievable through automated tracking systems. |

Key Technologies for Streamlined Reporting

In today’s fast-paced environment, the integration of innovative tools is essential to enhance the evaluation of financial transactions. These advancements not only simplify processes but also improve overall precision and reliability in data management. By leveraging cutting-edge solutions, organizations can achieve a cohesive framework that minimizes errors while maximizing productivity.

One of the pivotal components in this framework is automation software. Through the use of algorithms and machine learning, these systems can efficiently process a vast amount of data while reducing manual interventions. This not only accelerates the workflow but also significantly diminishes the likelihood of inaccuracies arising from human error.

Additionally, mobile applications are increasingly becoming indispensable in capturing and managing expenses on the go. They offer real-time synchronization, allowing users to effortlessly document transactions and submit reports from their smartphones or tablets. This convenience leads to quicker approvals and ultimately a more agile financial management process.

Another crucial technology is cloud-based platforms, which facilitate collaborative efforts among team members regardless of geographical locations. These systems provide a centralized repository for all financial information, ensuring everyone has access to the same up-to-date data. Furthermore, they enhance security and compliance by storing sensitive information in encrypted formats, safeguarding it from unauthorized access.

Lastly, data analytics tools play a vital role in transforming raw information into actionable insights. By employing advanced analytical techniques, organizations can identify trends, evaluate spending behaviors, and make informed decisions based on robust data. This capability not only supports strategic planning but also drives continuous improvement in financial practices.

Strategies to Reduce Expense Reporting Errors

Ensuring precision in financial submissions is critical for both individuals and organizations. Errors can lead to financial discrepancies, compliance issues, and decreased trust among stakeholders. Implementing effective strategies can significantly enhance the accuracy of financial documentation. Below are key approaches to minimize mistakes in this process.

Standardize the Submission Process

- Establish clear guidelines for how expenses should be documented.

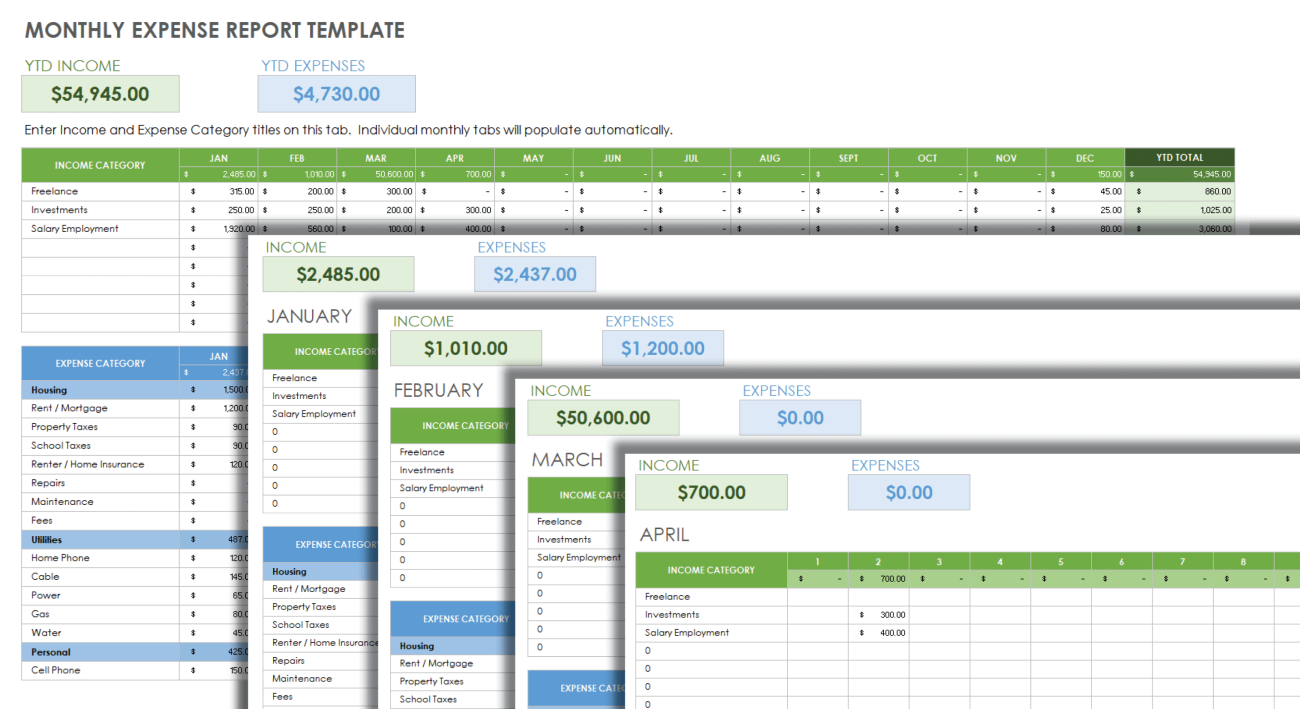

- Utilize templates that outline necessary information to be included.

- Provide training sessions to familiarize all team members with the standards.

Leverage Technology and Automation

- Adopt software solutions that automate data entry and calculations.

- Use mobile applications that allow for real-time tracking and submitting of expenses.

- Implement features like optical character recognition (OCR) to streamline receipt processing.

By integrating these methods, organizations can create a more reliable framework that reduces inaccuracies, minimizes the time spent on revisions, and ultimately improves the overall integrity of financial documentation.

Enhancing Team Collaboration on Expenses

Fostering a cohesive approach among team members can significantly influence the management of financial submissions. When everyone is engaged in a unified process, the potential for misunderstandings and miscommunications diminishes, leading to smoother workflows and improved outcomes. A collaborative atmosphere encourages transparency and shared responsibility, ensuring that all contributors feel valued and aligned with the organization’s goals.

Strategies for Collaborative Financial Management

Implementing effective strategies to enhance teamwork benefits the overall handling of financial submissions. Below are key approaches that organizations can adopt:

| Strategy | Description |

|---|---|

| Regular Check-Ins | Schedule routine meetings to discuss updates, challenges, and successes related to financial requests. |

| Shared Platforms | Utilize collaborative tools that allow team members to input, review, and track financial submissions collectively. |

| Clear Guidelines | Provide comprehensive guidelines that outline the expectations and processes for handling financial submissions. |

| Feedback Mechanisms | Create channels for team members to provide constructive feedback and suggestions on the processes followed. |

Benefits of Team Collaboration

Encouraging a collaborative spirit not only streamlines processes but also fosters a culture of accountability and trust. Team members are more likely to take ownership of their contributions when they feel part of a collective effort. Processes become more transparent, errors are minimized, and the overall quality of financial documents improves, ultimately benefiting the organization. By working together, teams can navigate complexities more adeptly and drive success in financial management.

Future Trends in Expense Management Solutions

The landscape of financial administration is continuously evolving, driven by advancements in technology and shifting organizational needs. As businesses aim to achieve a streamlined approach to tracking expenditures, innovative methodologies are emerging. This section highlights the anticipated trends that will shape the future of fiscal management tools, enabling organizations to optimize their financial workflows.

Integration of Artificial Intelligence

Artificial intelligence (AI) is poised to revolutionize how organizations handle their financial activities. By incorporating AI into management solutions, companies can expect:

- Automated Categorization: AI can efficiently classify transactions, reducing manual input and potential errors.

- Smart Insights: Predictive analytics will provide valuable forecasts based on spending habits, enhancing strategic decision-making.

- Enhanced Compliance: Machine learning algorithms can monitor expenditures for adherence to company policies and regulations.

Shift Toward Mobile Solutions

With the increasing reliance on mobile devices, financial management applications are becoming more accessible. The trend toward mobile solutions offers several benefits:

- Real-Time Tracking: Users can log transactions on the go, ensuring that records are current and accurate.

- Convenient Approval Processes: Managers can review and approve requests directly from their smartphones, speeding up the workflow.

- Increased User Engagement: Intuitive interfaces and mobile functionalities lead to higher participation rates among employees.

As these trends take shape, businesses will likely witness a significant enhancement in their financial processes, aligning them with modern digital practices and fostering a culture of transparency and accountability.

Questions and answers: Expense reporting overhaul

What are the primary challenges organizations face with traditional expense reporting?

Organizations face several challenges with traditional expense reporting, including time-consuming manual processes that increase the risk of errors and delays in reimbursement. Employees may struggle with a lack of clarity regarding what expenses are reimbursable, leading to confusion and potential frustration. Additionally, manual data entry can lead to inaccuracies that affect financial reporting and auditing. Lastly, traditional methods often lack integration with other financial systems, making it difficult to track expenses accurately and efficiently over time.

How can technology improve the efficiency of expense reporting?

Technology can greatly enhance the efficiency of expense reporting by automating many of the manual processes involved. For example, expense management software can streamline data entry through features like receipt scanning and automatic categorization of expenses. Integration with credit card and banking systems can eliminate the need for manual input, reducing the risk of errors. Moreover, real-time reporting allows finance teams to access up-to-date expense data, enabling quicker decision-making and better budget management. User-friendly mobile apps also empower employees to submit expenses on-the-go, which can lead to quicker reimbursements and increased satisfaction.

What role does employee training play in effective expense reporting?

Employee training is crucial for effective expense reporting as it ensures that team members understand the policies and procedures involved in submitting expenses. When employees are well-trained, they are more likely to comply with the required documentation and format, which minimizes errors and accelerates the approval process. Training sessions can cover the use of any technology or software being implemented, as well as clarify what types of expenses are eligible for reimbursement. Continuous training and updates can keep staff informed about any changes in the expense policy, fostering a culture of compliance and accuracy throughout the organization.

What are some best practices for managing expense reporting effectively?

To manage expense reporting effectively, organizations can implement several best practices. First, establishing clear and concise expense policies can help eliminate confusion and set expectations for employees. Next, utilizing expense management software can streamline processes and reduce the workload for both employees and finance teams. Regular audits of expense reports can also help identify discrepancies and enforce accountability. Encouraging timely submissions and reimbursements can improve cash flow and employee satisfaction. Finally, providing ongoing support and resources for employees, such as FAQs or a dedicated help desk, can enhance the overall experience and lead to more accurate expense reporting.

What impact does accurate expense reporting have on company finances?

Accurate expense reporting has a significant positive impact on company finances. It ensures that the organization is aware of its spending patterns and can allocate resources more effectively. By minimizing inaccuracies, companies can avoid overpayments and potential tax issues, which helps maintain financial health. Accurate reporting also enhances budgeting and forecasting efforts, as reliable expense data provides insights into future spending trends. Additionally, efficient expense reporting contributes to improved employee satisfaction and retention, as timely reimbursements and fewer complications create a more positive work environment, indirectly benefiting the company’s bottom line.

What are the main challenges companies face in expense reporting?

Companies often encounter several challenges in expense reporting, including inaccuracies in data entry, time-consuming manual processes, lack of standardized procedures, and difficulties in tracking receipts and approvals. These issues can lead to delayed reimbursements, employee dissatisfaction, and potential compliance risks. Additionally, without an efficient system, it can be challenging for organizations to analyze spending patterns or ensure policy adherence, further complicating financial management and oversight.

What are the main benefits of using an automated expense management tool compared to tracking expenses manually?

Using an automated expense management tool can save time, reduce errors, and provide real-time visibility into business expenses, making it a more efficient option than manual tracking. Automated expense reporting solutions streamline the process, eliminating the need to manually enter data into spreadsheets and enabling quick expense submission. This allows employees to focus on more strategic tasks instead of spending time on tedious expense tracking.

How can an automated expense reporting system improve the reconciliation and reimbursement process?

Automated expense reporting systems simplify the reconciliation process by allowing employees to submit expense reports with ease, often by snapping a photo of receipts. These systems provide real-time expense records and approval workflows, which help streamline reimbursement processes. By integrating with ERP or accounting software, companies can ensure that every expense is tracked accurately, speeding up reimbursement and improving overall efficiency in the expense process.

Why do businesses need to overhaul their traditional expense reporting methods?

Traditional expense reporting methods, like using spreadsheets, are often time-consuming and prone to human error. With a modern expense management platform, businesses can automate processes and gain real-time visibility into expenses. This overhaul is necessary to prevent expense fraud, improve compliance, and save time and money by automating expense records. By modernizing the expense reporting process, companies turn a tedious task into a strategic advantage.

How does travel expense management benefit from automation, and what role does it play in business expense tracking?

Travel expense management becomes significantly more efficient with automation, as it allows for easy tracking of various expense types incurred during business trips. Automated travel and expense management systems help submit expense reports in real time, capturing data on each transaction instantly. This approach not only ensures accuracy in business expense tracking but also offers a comprehensive view of travel expenses, enabling better budget control and faster expense reimbursement.

What key features should companies look for in a modern expense reporting software to streamline the expense management process?

Companies should look for expense reporting software that includes features like OCR technology for scanning receipts, approval workflows, real-time visibility, and integration with ERP or accounting software. These features make it easy to submit an expense, manage complex expense types, and prevent errors. Additionally, a platform with robust reporting systems can provide insights into spending trends, helping companies manage expenses more strategically and optimize their accounts payable process.