Revolutionizing Tax Solutions for Startups

In the dynamic landscape of emerging enterprises, the importance of solid financial guidance cannot be overstated. As new ventures strive for growth and sustainability, aligning with knowledgeable financial allies becomes a fundamental aspect of their journey. Understanding the intricacies of fiscal legislation, compliance, and strategic planning lays the groundwork for long-term prosperity.

The selection of an adept financial expert can significantly influence not only the operational efficiency but also the overall trajectory of a fledgling company. With an array of options available, it’s crucial to discern the attributes and support systems that resonate with the distinct requirements of an organization in its formative stages. Comprehensive insights into available choices empower entrepreneurs to make informed decisions, leading to better resource allocation and enhanced financial well-being.

Delving into the essential characteristics of effective financial collaborators reveals a multifaceted approach that encompasses expertise, communication, and adaptability. Establishing a partnership with the right entity fosters a climate of trust and innovation, catalyzing growth and ensuring compliance in an ever-evolving regulatory environment. By carefully evaluating potential candidates, one can set a strong foundation for the financial health of a nascent venture.

Understanding the Role of Tax Providers

In the dynamic landscape of entrepreneurship, the influence of financial specialists is paramount. Their expertise transcends mere number crunching; it encompasses a holistic approach to navigating fiscal responsibilities and maximizing profitability. This section elucidates the significant contributions these professionals make to the health and growth of emerging ventures.

The responsibilities of these experts can be broken down into several key areas:

- Compliance: Ensuring adherence to regulations and laws to avoid penalties.

- Strategic Planning: Offering insights that align financial strategies with overall goals.

- Efficiency Optimization: Streamlining financial processes to enhance productivity.

- Risk Management: Identifying and mitigating potential fiscal threats.

- Advisory Services: Providing tailored advice based on the unique needs of the business.

Moreover, collaborating with skilled financial consultants aids in fostering a proactive approach towards financial health. This relationship empowers enterprises to focus on their core operations while leaving comprehensive fiscal responsibilities to those well-versed in the intricacies of finance.

In conclusion, the participation of these professionals is instrumental in creating a solid foundation for prosperity. Their role transcends conventional expectations, making them a vital asset in navigating the ever-evolving world of commerce.

Key Factors in Selecting the Right Expert

Finding the appropriate specialist to assist with financial obligations is crucial for any organization striving to flourish. Various elements must be considered to ensure that the chosen consultant aligns with the specific requirements and goals of the enterprise. A proper assessment of expertise, compatibility, and support can significantly influence long-term prosperity.

First and foremost, evaluate the professional’s experience within your industry. It is vital to select someone who possesses a deep understanding of the unique challenges and opportunities that your field presents. An expert with relevant background knowledge will be better equipped to provide tailored advice and solutions that resonate with your operational model.

Additionally, communication skills should not be overlooked. A proficient advisor must be able to convey complex concepts clearly and effectively. Open lines of communication are fundamental for developing a trusting relationship, ensuring that you are well-informed and confident in the strategies being implemented.

Furthermore, consider the range of services offered. An ideal consultant should provide a holistic approach, addressing various aspects of financial management rather than specializing in just one area. This comprehensive perspective allows for more cohesive strategies that can adapt to your evolving needs over time.

Lastly, the reputation of the professional plays a significant role in the selection process. Researching reviews, testimonials, and case studies can provide valuable insights into their track record and level of client satisfaction. Weighing these factors can lead to a more informed decision, ultimately contributing to the growth and stability of your organization.

Common Services Offered by Tax Professionals

Engaging with financial experts can significantly enhance the operational efficiency of a company. These specialists possess an array of essential functions that can help navigate the intricacies of fiscal obligations and regulatory compliance. Their expertise is invaluable in optimizing financial performance and ensuring adherence to laws.

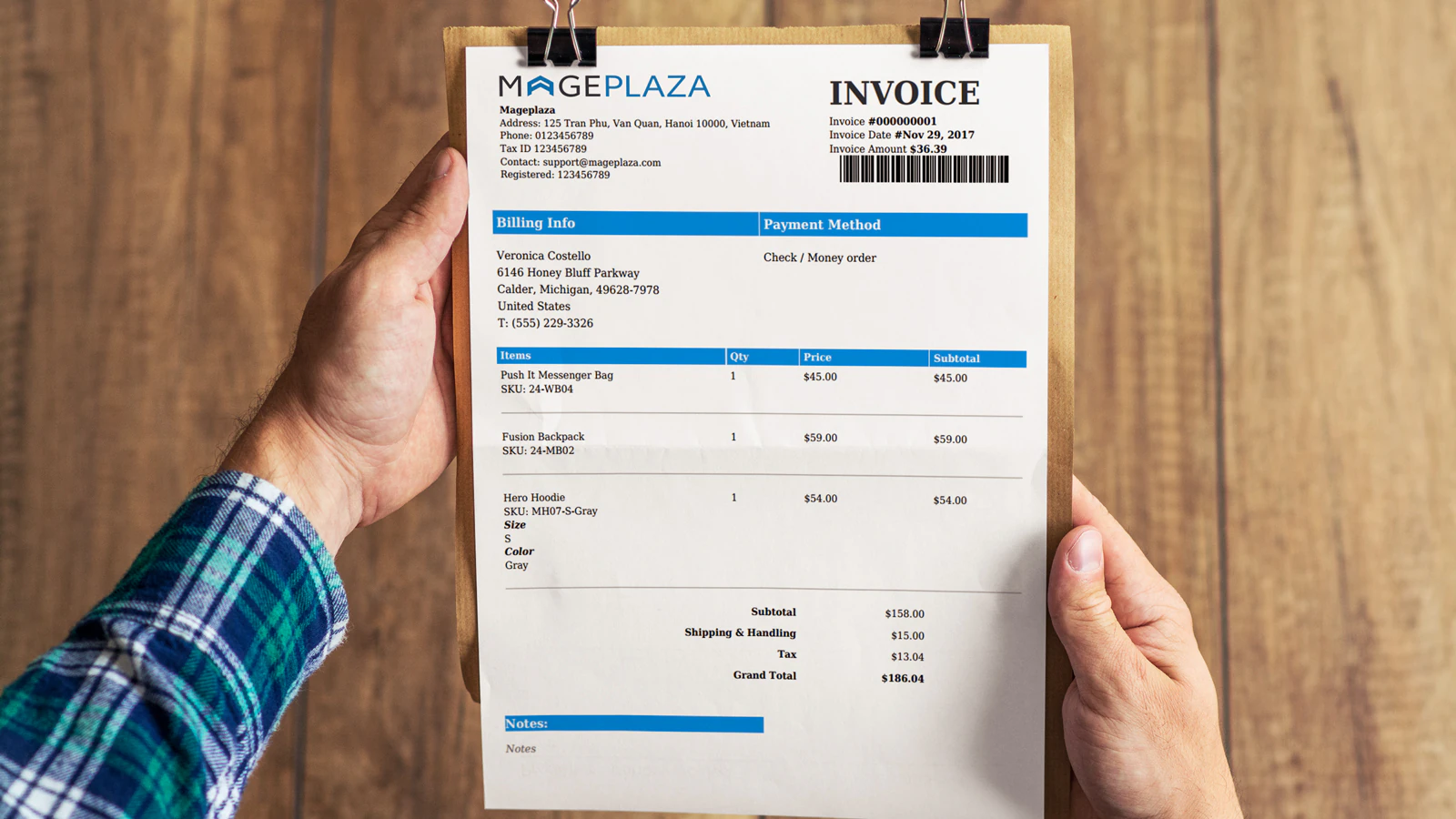

Preparation of Financial Statements is one of the primary roles these professionals undertake. Accurate financial statements are vital for both internal decision-making and external reporting requirements. They ensure that all documents reflect the true financial position of the entity.

Compliance Assistance is crucial for avoiding penalties and ensuring that all submissions are timely and accurate. Professionals guide clients through the maze of regulations, ensuring that all deadlines are met and required forms are correctly filled out.

Consultation on Strategic Tax Planning can lead to more effective financial management. By analyzing current situations and future goals, these experts can recommend strategies for minimizing liabilities and maximizing savings through allowable deductions and credits.

Representation in Audits provides peace of mind during interactions with regulatory agencies. Experienced professionals can advocate on behalf of their clients, ensuring that rights are protected and the process is handled smoothly.

Advice on Entity Structure is another key service. The choice of business structure can significantly impact taxes. Experts evaluate the implications of different structures, helping clients select the one that aligns best with their objectives and minimizes tax exposure.

With these services, financial professionals play a pivotal role in shaping a company’s financial landscape, allowing entrepreneurs to focus more on growth and less on compliance burdens.

Evaluating Cost-Effectiveness of Tax Solutions

When navigating the realm of financial compliance, assessing the value of various services becomes paramount. The chosen route should not only meet the regulatory standards but also align with the long-term financial goals of the organization. A thoughtful examination of costs versus benefits can yield insights into the most advantageous options available.

Understanding the Value Proposition

It’s crucial to recognize what is being offered against the price tag. Elements such as expertise, technology, and personalized assistance can significantly impact overall satisfaction and efficiency. Analyze how these factors contribute to minimizing liabilities and streamlining processes, which ultimately fosters growth and stability.

Breaking Down Potential Costs

A comprehensive review of anticipated expenses should consider both direct fees and indirect costs that may arise. Hidden charges can often inflate the total expenditure, so transparency from the service may indicate reliability. Evaluate the long-term impact against immediate savings to determine whether the investment is truly sensible. In the end, a balanced perspective will lead to a more informed choice that supports the mission of the enterprise.

Importance of Industry-Specific Knowledge

Understanding the nuances of specific sectors can significantly influence the effectiveness of professional services. Expertise in particular industries not only fosters deeper insights but also enhances the ability to navigate complex regulations and unique challenges. This specialized knowledge serves as a foundation for making informed decisions that drive growth and compliance.

Benefits of Specialized Expertise

- Tailored Strategies: Professionals with industry-specific insights can craft strategies that align with the unique dynamics of a given sector.

- Regulatory Compliance: Familiarity with industry standards and compliance requirements ensures that businesses adhere to necessary legal frameworks.

- Risk Mitigation: An understanding of sector-specific risks allows for the implementation of proactive measures to safeguard the organization.

Choosing the Right Partner

Selecting a knowledgeable professional entails assessing their experience and understanding of your particular field. Prioritize individuals or firms that have a proven track record in similar industries. Key factors to consider include:

- Previous client testimonials and case studies.

- Professional certifications and continuing education.

- Participation in industry associations and events.

Ultimately, partnering with a knowledgeable individual or firm is instrumental in achieving optimal outcomes and ensuring smooth operational processes.

How to Build a Strong Partnership

Creating a robust alliance involves a commitment to mutual growth and understanding. It is essential to cultivate a relationship based on trust, transparent communication, and shared goals. By establishing a solid foundation, both parties can leverage their strengths and address challenges effectively.

| Key Elements | Description |

|---|---|

| Open Communication | Foster an environment where ideas and concerns can be freely expressed. |

| Shared Objectives | Align on common goals to ensure both parties work collaboratively toward achieving them. |

| Trust and Integrity | Build confidence through honesty and the consistent fulfillment of commitments. |

| Regular Check-ins | Schedule periodic meetings to review progress and address any emerging issues promptly. |

| Flexibility and Adaptability | Be willing to adjust strategies and approaches as circumstances evolve. |

Investing time in nurturing this partnership will ultimately lead to collaboration that drives innovation, increases efficiency, and ultimately achieves shared aspirations.

Q&A: Startup tax provider

What role do tax credits play in the financial planning of startups?

Tax credits play a crucial role in the financial planning of startups by reducing their tax liability. They can provide significant savings and help startups manage their cash flow more effectively. By utilizing available tax credits, startups can lower their overall tax burden and reinvest savings into business growth.

How can a tax service benefit a startup?

A tax service can benefit a startup by offering expert guidance on tax planning, preparation, and compliance. They help ensure that all tax returns are filed accurately and on time, assist with identifying eligible tax credits and deductions, and provide support for navigating complex tax regulations, which is essential for startup success.

Why is bookkeeping important for managing franchise tax?

Bookkeeping is important for managing franchise tax as it ensures accurate tracking of financial transactions and proper record-keeping. Accurate bookkeeping helps in calculating the franchise tax liability correctly, maintaining compliance with state regulations, and preparing precise tax returns to avoid penalties.

What are the key considerations for a startup when dealing with franchise tax?

Key considerations for a startup dealing with franchise tax include understanding the tax regulations specific to their state, such as the Delaware franchise tax, maintaining accurate financial records, and ensuring timely tax payments. Consulting with a tax service can help startups navigate these requirements and avoid costly mistakes.

How does payroll tax affect the financial operations of a startup?

Payroll tax affects the financial operations of a startup by adding to the overall cost of employing staff. Startups must account for various payroll taxes, including Social Security and Medicare taxes, which need to be accurately calculated and reported. Proper management of payroll taxes ensures compliance and avoids potential legal issues.

What services are typically included in tax preparation for startups?

Tax preparation services for startups typically include preparing and filing federal and state tax returns, identifying and claiming eligible tax credits and deductions, and ensuring compliance with tax regulations. These services help startups manage their tax obligations effectively and minimize their tax liability.

How can tax filing impact a startup’s financial health?

Tax filing impacts a startup’s financial health by determining its tax obligations and ensuring compliance with tax laws. Proper tax filing helps avoid penalties and interest charges, ensures accurate reporting of income and expenses, and can potentially lead to tax refunds or credits that improve the startup’s financial position.

What is the significance of tax compliance for a startup?

Tax compliance is significant for a startup because it ensures adherence to tax laws and regulations, helping avoid legal issues and penalties. By maintaining tax compliance, startups can focus on growth and development, secure funding more easily, and establish a good financial reputation with investors and stakeholders.

How can a tax service for startups assist with corporate tax matters?

A tax service for startups can assist with corporate tax matters by providing expert advice on tax planning, preparing and filing corporate tax returns, and ensuring compliance with corporate tax regulations. They also help with optimizing tax strategies to minimize liabilities and manage financial risks effectively.

What are the advantages of using a specialized accounting firm for startup tax services?

Using a specialized accounting firm for startup tax services offers advantages such as expert knowledge of tax laws, personalized tax planning, and accurate tax preparation. These firms help startups navigate complex tax issues, maximize tax credits and deductions, and ensure timely and compliant tax filing, which is crucial for business success.

How can a startup benefit from comprehensive tax services?

A startup can benefit from comprehensive tax services by receiving expert advice on tax planning, compliance, and optimization. This includes assistance with understanding complex tax laws, maximizing tax credits like the R&D tax credit, and ensuring timely and accurate filing of federal and state tax returns. Comprehensive services help startups manage their tax obligations efficiently, saving money and avoiding penalties.

What are the key tax deadlines that a startup must be aware of?

Key tax deadlines for startups include the due dates for federal and state income tax returns, quarterly estimated tax payments, and payroll tax filings. It’s important for startups to adhere to these deadlines to avoid late fees and penalties. Consulting with a startup tax accountant can help ensure all deadlines are met accurately.

How does the R&D tax credit benefit startups?

The R&D tax credit benefits startups by providing a tax incentive for investing in research and development activities. This credit can significantly reduce a startup’s tax liability, allowing them to reinvest those savings into further innovation and growth. Proper R&D tax credit analysis can maximize these benefits.

What role does a CFO service for startups play in managing tax obligations?

A CFO service for startups plays a critical role in managing tax obligations by overseeing financial strategy, ensuring compliance with tax regulations, and optimizing tax planning. They help startups navigate complex tax laws, handle tax filing and reporting, and identify opportunities for tax savings.

What should startups include in their tax documents to ensure proper filing?

Startups should include accurate records of income, expenses, payroll, and any relevant tax credits or deductions in their tax documents. This includes maintaining detailed bookkeeping records, preparing financial statements, and gathering supporting documentation for claims such as the R&D tax credit.

Why is it important for startups to use specialized tax accountants?

Specialized tax accountants are important for startups because they provide expertise in navigating complex tax laws, ensuring compliance, and identifying tax-saving opportunities. They offer tailored advice and help manage both federal and state tax obligations, which is crucial for the financial health and growth of startups.

How can startups save money through tax planning?

Startups can save money through tax planning by utilizing available tax credits, optimizing deductions, and employing strategic tax strategies. Effective tax planning involves understanding tax regulations, managing tax obligations proactively, and leveraging credits like the R&D tax credit to reduce overall tax liability.

What are common tax mistakes startups should avoid?

Common tax mistakes startups should avoid include failing to keep accurate financial records, missing tax deadlines, and not properly claiming eligible tax credits or deductions. Ensuring accurate bookkeeping, timely tax filing, and consulting with a tax expert can help avoid these mistakes.

How does local and state tax impact startups?

Local and state taxes impact startups by adding to their overall tax liability and influencing financial decisions. Startups must be aware of specific local and state tax regulations to ensure compliance and manage their tax burden effectively. This includes understanding local tax rates and filing requirements.

What is the significance of understanding tax regulations for growing startups?

Understanding tax regulations is significant for growing startups as it helps them comply with legal requirements, avoid penalties, and manage their financial strategy effectively. It enables startups to make informed decisions, optimize tax savings, and focus on business growth while staying compliant with evolving tax laws.