Maintaining transparency and exactitude in financial transactions is vital for fostering trust and long-lasting relationships with clients. Establishing a reliable method of documenting monetary exchanges can not only enhance your organization’s reputation but also streamline operations. Ensuring that each financial interaction is handled with care will set the foundation for future collaborations and customer satisfaction.

In an environment where every detail counts, the importance of having a robust system cannot be overstated. Detailed records contribute to seamless communication, minimize misunderstandings, and provide the necessary framework for resolving disputes. When everyone involved has access to clear and precise information, the path to achieving a successful outcome becomes much more attainable.

Implementing strategies that prioritize clarity and thoroughness will serve to bolster your financial integrity. By embracing certain methodologies, organizations can not only safeguard their interests but also provide exceptional service to their clients. Such an approach paves the way for enhanced professionalism and reliability in all interactions.

Establishing Clear Invoicing Guidelines

Creating well-defined protocols for the billing process is crucial for maintaining professionalism and fostering trust between service providers and clients. Clarity in these protocols minimizes misunderstandings and ensures that all parties are on the same page regarding expectations, payment terms, and deliverables. By setting a solid foundation, one can enhance customer satisfaction and streamline operations.

Defining Essential Elements

When formulating these protocols, it is vital to outline key components such as payment terms, itemized descriptions of services rendered, and contact information for queries. This level of detail aids in preventing disputes and reinforces the integrity of the transaction. Including a clear timeline for payment also promotes timely transactions and can encourage prompt action from customers.

Regular Reviews and Updates

It is equally important to periodically review and adjust these guidelines based on feedback and changing circumstances. Staying adaptable ensures that the standards remain relevant and effective. Additionally, communicating any updates with clients builds transparency and reinforces a strong relationship, ultimately benefiting all parties involved.

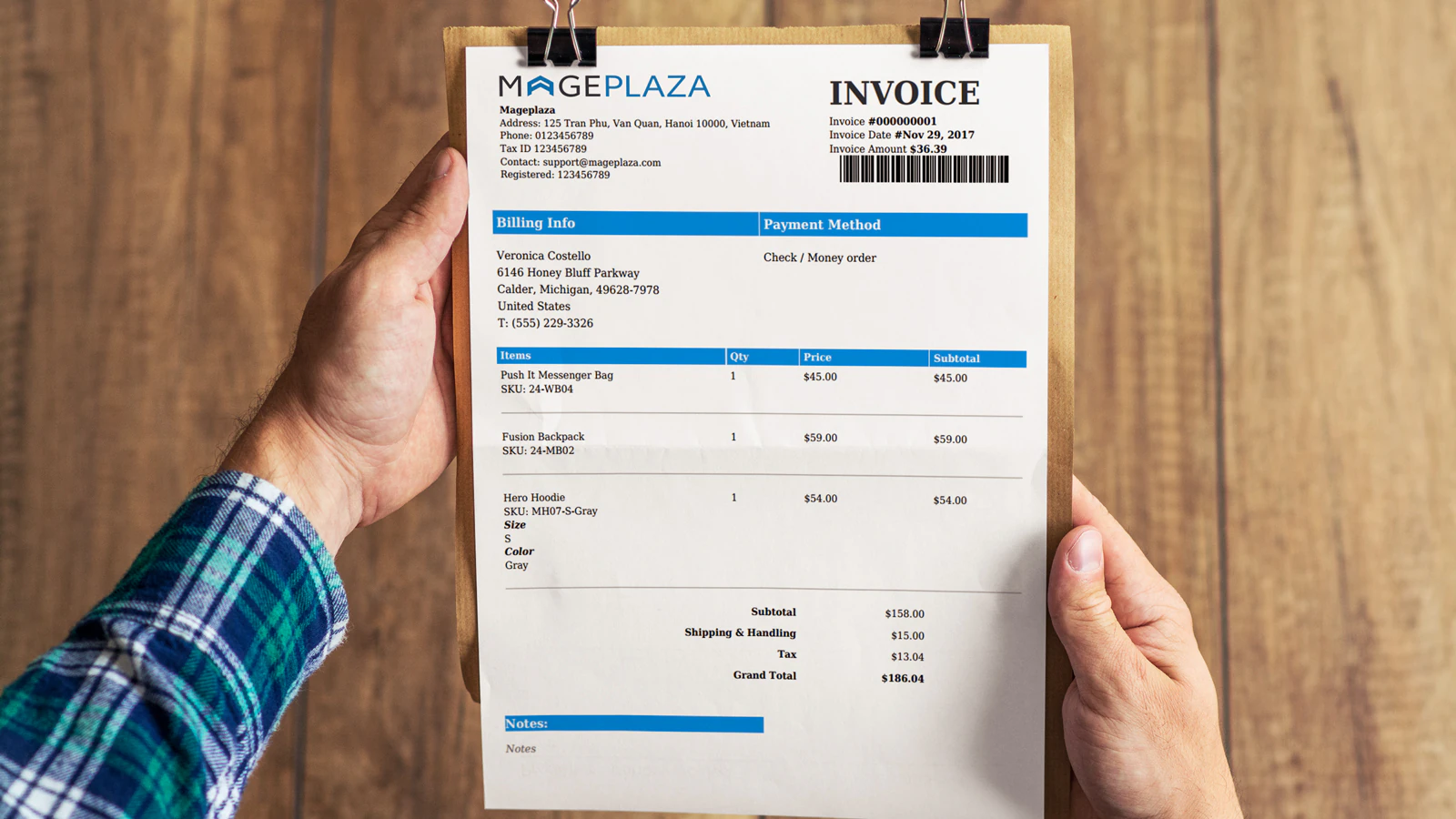

Utilizing Professional Invoice Templates

The implementation of high-quality document formats plays a crucial role in ensuring streamlined financial communication. These structured designs not only contribute to a polished aesthetic but also enhance the clarity of essential information exchanged between parties. By adopting well-crafted formats, you provide an organized presentation of services or products rendered, promoting transparency and professionalism in every transaction.

Utilizing these expertly designed templates can greatly simplify the documentation process. They often include pre-defined sections for all necessary details, allowing for efficient completion while minimizing the risk of omitting vital information. With a consistent layout, clients will quickly recognize your correspondence, fostering familiarity and trust.

Moreover, ready-made layouts can be easily customized to fit specific requirements. This flexibility enables you to incorporate branding elements such as logos and colors, thereby reinforcing your identity. Tailoring these formats ensures you not only convey important details but also create a lasting impression on your clientele.

Incorporating digital solutions further enhances the utility of these templates. Many platforms offer intuitive features, including automated calculations and invoice tracking, which save time and reduce errors. As a result, you can focus on your core operations while maintaining a high standard of document accuracy.

Ensuring Timely Invoice Delivery

Prompt submission of financial documents is crucial in maintaining positive client relationships and ensuring smooth cash flow. An efficient approach to this aspect can significantly enhance operational efficiency and trustworthiness, benefiting all parties involved. Timeliness not only reflects professionalism but also sets the tone for clear communication and mutual respect.

Establish Clear Deadlines

Setting explicit due dates for delivering financial documents is essential. Make it a practice to communicate these timelines clearly with clients, creating an expectation that aligns with your workflow. Utilizing digital calendars and reminders can help keep these commitments on track, facilitating timely actions.

Utilize Automated Solutions

Implementing technology can streamline the process of sending financial documents. Automation tools can generate, schedule, and monitor the dispatch of invoices, ensuring they reach clients without delay. This not only saves time but also minimizes the risk of human error, ultimately fostering a more reliable system.

Emphasis on consistency in delivery reinforces professional integrity and can encourage quicker payments, establishing a rhythm that benefits both the service provider and the client. Regular follow-ups can further solidify this routine, ensuring that balances remain at an acceptable level.

Maintaining Accurate Record Keeping

Effective documentation is crucial for any organization aiming to thrive in today’s competitive landscape. Keeping meticulous and organized records not only helps in tracking progress but also fosters transparency and reliability in operations.

- Consistent Documentation: Regularly update records to reflect the current status of transactions. This habit ensures that no important detail is overlooked.

- Use of Technology: Implement software solutions designed for tracking and managing financial information. Automation can minimize human errors and enhance efficiency.

- Regular Audits: Schedule periodic reviews of your records. This can help identify discrepancies early and facilitate corrective actions.

Keeping accurate records also involves setting clear protocols for data entry. Training staff on proper methods can significantly reduce the margin for error.

- Define a standard format for all documents.

- Establish designated personnel for record management.

- Implement backup processes to safeguard against data loss.

By prioritizing systematic record keeping, organizations can enhance overall performance and build trust with stakeholders.

Transparent Communication with Clients

Clear and open dialogue is fundamental in fostering trust between service providers and their clients. Establishing an atmosphere of honesty encourages positive interactions and minimizes misunderstandings. When clients feel informed and engaged, their satisfaction and loyalty tend to increase, leading to stronger relationships and successful collaborations.

Effective Information Sharing

Providing detailed explanations regarding services rendered, payment terms, and project updates can significantly enhance transparency. Utilize clear language that avoids jargon to ensure that clients fully grasp the information presented. Regular updates, whether via email or meetings, can keep clients in the loop, promoting a sense of involvement and transparency throughout the process.

Encouraging Client Feedback

Creating opportunities for clients to share their thoughts and concerns is crucial. Implementing feedback mechanisms, such as surveys or direct discussions, allows clients to voice their opinions, helping you to refine your offerings. Listening to clients not only demonstrates that their perspectives are valued but also builds a foundation of mutual respect that can lead to long-term partnerships.

Reviewing and Auditing Invoices Regularly

Routine examination and assessment of financial documents play a crucial role in maintaining the integrity of any financial operation. Ensuring that all entries are accurate and reflect actual transactions helps to cultivate trust with clients and suppliers alike. This approach not only fosters transparency but also minimizes the risk of errors that can lead to disputes or financial loss.

Engaging in systematic evaluations aids in identifying discrepancies early on. Regular checks allow for timely corrections, which ultimately contribute to a smoother workflow. Additionally, this habit encourages the development of standardized processes, making it easier to trace errors and implement solutions swiftly.

Moreover, involving multiple perspectives in the review process can prove beneficial. Whether through peer reviews or supervisor assessments, collaborative scrutiny amplifies accuracy. This not only diversifies insights but also strengthens team accountability to uphold high standards in financial reporting.

Incorporating a consistent schedule for these evaluations helps in establishing a disciplined approach to financial management. Creating a culture centered around regular audits supports proactive rather than reactive handling of discrepancies, ensuring long-term operational health.

Questions and answers: Invoicing practices honesty and accuracy

What are the key benefits of using invoicing best practices in my business?

Utilizing invoicing best practices ensures honesty and accuracy in your financial transactions, which builds trust with clients. It helps to minimize errors, reduce disputes, and improve cash flow through timely payments. By standardizing your invoicing process, you can also enhance your professionalism and maintain a clear record of your financial activities, which is essential for tax purposes and financial planning.

Should I implement any specific software for invoicing to enhance accuracy?

Yes, using dedicated invoicing software can significantly enhance the accuracy of your invoicing processes. Such software typically includes features like automated calculations, built-in templates, and reminders for overdue payments, thus reducing human error. Furthermore, many invoicing programs integrate with accounting systems, allowing for seamless management of your finances, which can save time and ensure accuracy in your records.

What information is essential to include on an invoice to avoid disputes?

To prevent disputes and ensure clarity, your invoices should include the following essential information: your business name and contact details, the client’s name and contact information, a unique invoice number, invoice date, a detailed description of the products or services provided, their quantities, and prices. Additionally, outline payment terms, including due dates and accepted payment methods. Providing this complete and clear information can help mitigate misunderstandings and facilitate timely payments.

How can I ensure timely payments while maintaining a good relationship with my clients?

To ensure timely payments while fostering strong client relationships, communicate your payment terms clearly from the outset and send invoices promptly after delivering goods or services. You might also consider offering multiple payment methods and sending gentle reminders as the due date approaches. Building rapport with your clients through regular, friendly communication can go a long way in encouraging prompt payment. Additionally, consider incorporating a small discount for early payments as an incentive.

How can businesses ensure the integrity and accuracy of their invoices to maintain financial health?

Businesses can ensure the integrity and accuracy of their invoices by implementing a verification process, using reliable accounting software, and closely reviewing invoice details before sending them to clients. This helps avoid invoicing mistakes, overcharge, and ensures compliance with ethical billing practices.

What are best practices for invoice creation to improve the overall customer experience?

Best practices for invoice creation include ensuring accurate invoices, adhering to a clear billing schedule, and providing detailed timesheets for billable hours. Efficient invoice workflows and offering online payments options can further enhance the customer experience by streamlining the payment process.

How can time tracking and process automation improve billing accuracy?

Implementing automatic time tracking and process automation can significantly improve billing accuracy by reducing human errors and ensuring that all billable hours and expenses are captured in real-time. This allows businesses to issue invoices more quickly and ensures that invoices are sent with accurate information.

What role does record-keeping play in professional service businesses for avoiding unethical billing practices?

In professional service businesses, record-keeping plays a crucial role in avoiding unethical billing practices by ensuring that all billable hours and expenses are properly documented. Proper timesheets and clear agreements with clients and consultants help maintain accountability and transparency, ensuring honest billing and legal compliance.

How can businesses optimize their invoice workflows to prevent late payments?

Businesses can optimize their invoice workflows by adopting efficient tracking systems, issuing proper invoices in real-time, and setting clear agreements with clients regarding payment terms. This can prevent late payments by ensuring that invoices are sent promptly, with all required invoice details and a clear payment process.