In the landscape of employment, distinctions between various roles play a crucial part in defining responsibilities, rights, and compensation. These differences can significantly impact both individuals navigating their career paths and organizations seeking to align their workforce effectively. By grasping the nuances between distinct job categories, employees can better understand their position and the implications associated with it.

Exploring the various designations in the labor market reveals a framework within which professionals function and receive remuneration. Certain individuals enjoy specific perks and entitlements based on their job title and duties, while others may adhere to different standards that reflect their work situation. This article aims to demystify these categories, shedding light on essential aspects and the criteria used to determine each role.

Understanding these separations is pivotal for both the employees who occupy such roles and the organizations that employ them. By clarifying expectations and obligations, all parties involved can foster a healthier work environment that promotes transparency and fairness. Join us as we delve into the specifics of employment roles and their implications for all stakeholders in the workforce.

Understanding Employee Classification Basics

The distinction between different categories of personnel plays a crucial role in the workplace, influencing both responsibilities and entitlements. It is essential to grasp the foundational concepts that govern how individuals are placed within these categories, as this affects various aspects of employment law, compensation, and benefits.

At its core, this framework classifies individuals based on their job functions, salaries, and the level of authority exercised in their positions. This differentiation not only determines eligibility for overtime pay but also sets the tone for various employment rights and privileges. Understanding these fundamental principles helps both employers and professionals navigate the complex landscape of labor regulations.

Recognizing these distinctions is vital for ensuring compliance with laws that protect the rights and well-being of individuals in the workforce. By familiarizing oneself with the types of roles and their associated characteristics, companies can better manage human resources and maintain a fair working environment.

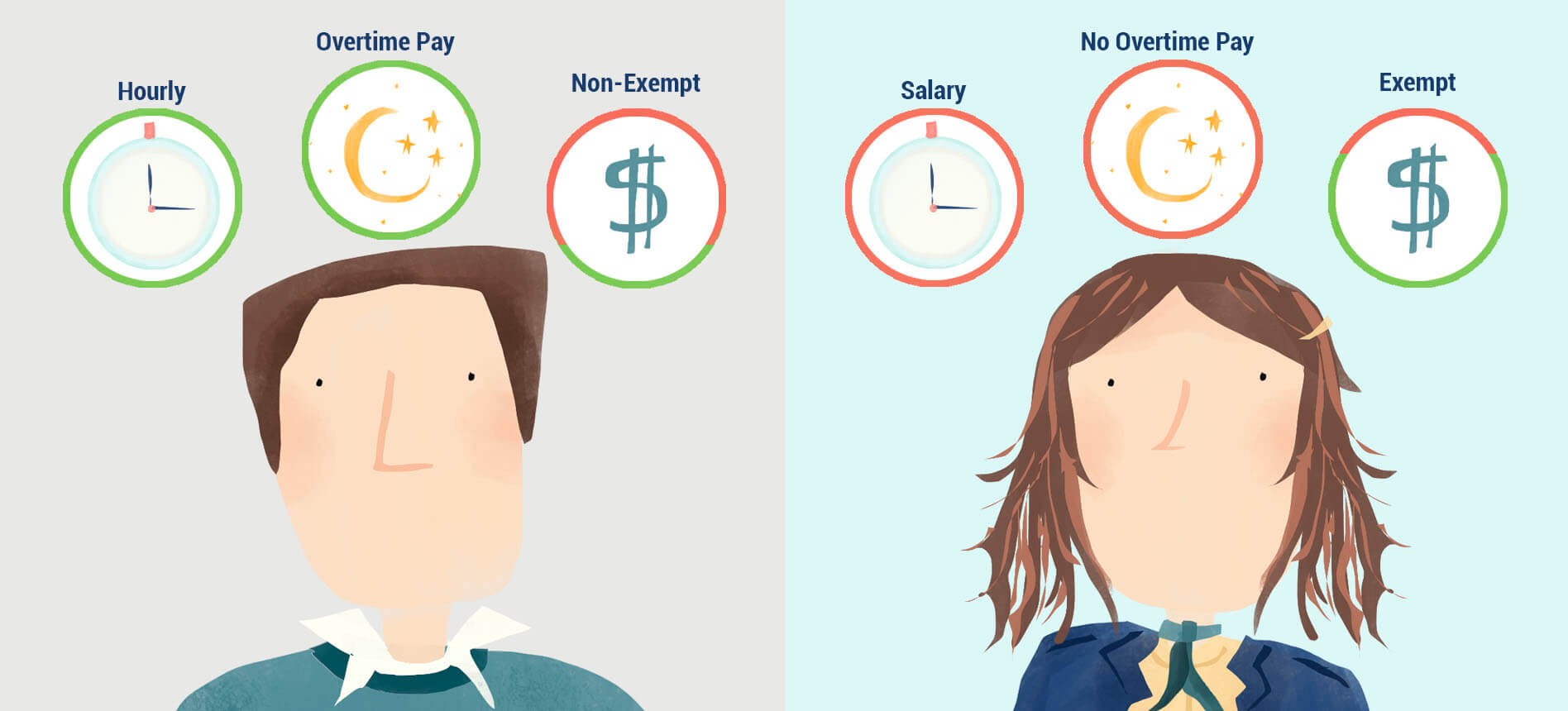

Key Differences Between Worker Types

Understanding the distinctions between various categories of personnel is crucial for both employers and employees. These differences significantly impact compensation, work schedules, and eligibility for specific benefits. Here are the primary aspects that differentiate these two groups.

- Compensation Structure:

- One category typically receives a fixed salary regardless of hours worked.

- The other often earns hourly wages, leading to potential overtime pay.

- Overtime Eligibility:

- One group is entitled to overtime pay for hours exceeding a standard workweek.

- The second may not receive additional compensation for extra hours put in.

- Job Responsibilities:

- One category generally involves more specialized tasks, often requiring a degree of autonomy.

- The other may have more narrowly defined duties that are closely monitored.

- Benefits Access:

- Healthcare, retirement plans, and vacation days may differ greatly between the two groups.

- One may have comprehensive access to benefits, while the other might encounter limitations.

- Work Schedule Flexibility:

- One type usually enjoys greater flexibility in setting their hours.

- In contrast, the other may be required to adhere to a strict schedule.

These fundamental distinctions affect daily operations, employee satisfaction, and overall workplace dynamics, shaping the employer-employee relationship in significant ways.

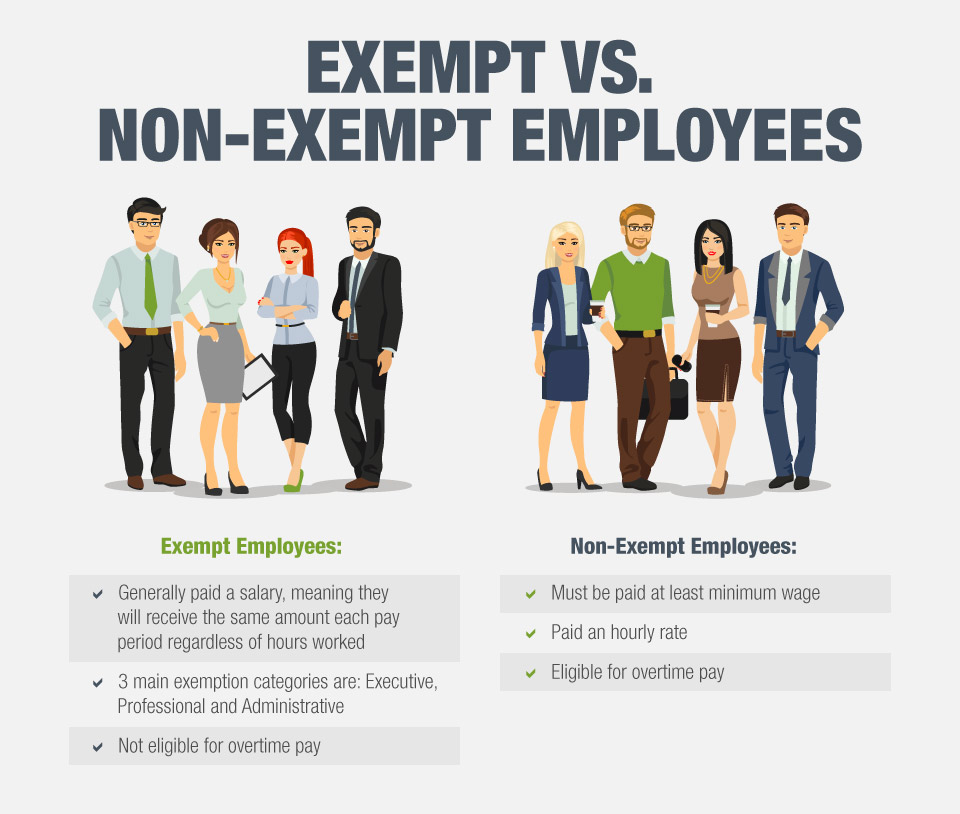

Criteria for Exempt Employees

Understanding the criteria that distinguish certain roles within organizations is essential for proper management and compliance with labor regulations. These criteria help identify positions with specific responsibilities and levels of authority, which in turn influence aspects such as compensation, overtime eligibility, and job expectations.

Key Indicators of Exemption

To determine if a position qualifies under this category, several primary indicators are taken into account. First, the nature of the job duties is evaluated. Roles that involve significant decision-making authority, advanced knowledge, or creativity typically qualify. For example, positions in executive management or skilled professions often meet these criteria due to the independent judgment required.

Salary and Compensation Structure

The compensation structure also plays a crucial role in this evaluation. Positions that receive a predetermined salary rather than hourly wages are more likely to align with the specified criteria. Moreover, the salary must exceed the established thresholds set by federal and state regulations to be considered under this designation.

Organizations must carefully assess these aspects to ensure compliance and proper classification, thereby safeguarding both employer interests and employee rights.

Identifying Non-Exempt Positions

Recognizing roles that qualify for particular wage standards is crucial for both employers and employees. Certain job descriptions and responsibilities are inherently linked to overtime eligibility, impacting compensation structures. Understanding the characteristics that define these positions helps ensure compliance with labor regulations and fair treatment in the workplace.

Key Characteristics

Several attributes can signal that a position falls under specific wage protections. These elements include job duties, level of supervision, and the nature of the tasks performed. Analyzing these components provides clarity regarding entitlement to overtime pay and minimum wage protections.

Examples of Typical Roles

Below is a table outlining common job titles that typically align with the criteria for qualifying for wage protections:

| Job Title | Primary Responsibilities |

|---|---|

| Retail Sales Associate | Engaging with customers, processing sales, and managing inventory. |

| Administrative Assistant | Performing clerical tasks, scheduling appointments, and supporting office operations. |

| Manufacturing Worker | Operating machinery, assembling products, and ensuring quality control. |

| Food Service Employee | Preparing food, serving customers, and maintaining kitchen cleanliness. |

Identifying criteria for these roles helps maintain fairness in compensation and adherence to relevant employment laws, ensuring that individuals receive the benefits they deserve based on their responsibilities.

Overtime Regulations and Compliance

The management of additional hours worked beyond the standard schedule is a critical aspect of labor law that aims to ensure fair compensation. Organizations must navigate various guidelines that dictate when extra time is applicable and how to properly compensate individuals for their increased workload. Clear understanding and adherence to these stipulations are essential to maintain compliance and avoid potential legal issues.

Typically, overtime pay is calculated at a higher rate than the regular compensation, incentivizing productivity while providing financial protection for those who extend their working hours. Various factors influence eligibility for this additional pay, including job roles and specific responsibilities. Employers should regularly review their practices to ensure that all applicable laws are followed, as discrepancies can lead to significant penalties.

Furthermore, keeping accurate and comprehensive records of hours worked is paramount. Employers should implement effective timekeeping systems that track both regular and additional hours to facilitate compliance. Regular training sessions can also equip management and staff with the necessary knowledge to correctly interpret and implement these regulations.

Ultimately, a thorough understanding of overtime practices fosters a positive workplace environment, enhances employee satisfaction, and safeguards the organization against non-compliance issues. By prioritizing fair treatment and adherence to legal standards, companies can build trust and maintain a productive workforce.

Implications for Employers and Employees

The understanding of differing employment categories holds significant consequences for both organizations and individuals engaged in various occupations. Grasping the nuances surrounding these classifications helps to ensure compliance with labor laws and promotes a fair working environment. This section highlights the important factors each party must consider to navigate this complex landscape effectively.

Considerations for Employers

Employers must be vigilant in distinguishing between the various types of roles within their workforce. Misclassification can lead to substantial penalties, including back wages and legal fees. Additionally, understanding these differences enables better management of labor costs, benefits allocation, and overall workplace dynamics. Implementing appropriate training and maintaining accurate records can further mitigate risks associated with misinterpretation of the regulations.

Impacts for Individuals

For individuals, knowing their employment status is crucial for understanding their rights and entitlements within the workplace. This knowledge can affect compensation, benefits eligibility, and overtime opportunities. Being informed allows individuals to make better decisions regarding their career paths and advocate effectively for their needs within the organization. Awareness of one’s classification fosters a more transparent dialogue between employees and employers, ultimately contributing to a healthier work environment.

Resources for Further Information

Understanding the nuances of employment types can be vital for both employers and individuals navigating the workforce. To assist in this process, numerous resources are available that provide valuable insights and detailed information on various employment categories and their implications. Below, you will find a compilation of references that can enhance your knowledge and guide you in making informed decisions.

Government Resources

Official government websites often serve as the most reliable source of information regarding labor laws and employment standards. The U.S. Department of Labor provides comprehensive resources that cover rights, responsibilities, and current regulations affecting different job roles. Additionally, your state’s labor department can offer localized information tailored to your area.

Professional Organizations

Numerous professional associations focus on employment issues, ensuring their members are equipped with up-to-date information. Organizations such as the Society for Human Resource Management (SHRM) and National Employment Lawyers Association (NELA) provide research, articles, and seminars that can clarify complex employment classifications and support best practices in various industries.

By leveraging these resources, individuals and businesses can navigate the complexities of employment standards with greater ease and assurance.

Questions and answers: Exempt vs non-exempt workers simplify employee classification

What is the difference between exempt and non-exempt workers?

The primary difference between exempt and non-exempt workers lies in their eligibility for overtime pay under the Fair Labor Standards Act (FLSA). Exempt workers are those who are not entitled to overtime pay and typically receive a salary rather than hourly wages. They often hold managerial, professional, or administrative positions and meet specific criteria set by the FLSA. Non-exempt workers, on the other hand, are eligible for overtime pay when they work more than 40 hours in a week and are usually paid hourly. Understanding this classification is crucial for both employers and employees to ensure proper compensation and compliance with labor laws.

How can I determine if I am classified as exempt or non-exempt?

To determine your classification, consider several factors, including your job duties, salary, and the nature of your employment. First, review your job responsibilities; if your role involves executive, administrative, or professional tasks, you may qualify as exempt. Second, check your salary; to be classified as exempt, you typically need to earn above a certain threshold set by the FLSA (which can vary by state). Additionally, employers should provide clear information about their classification process, so reviewing your employee handbook or discussing with HR can help clarify your status.

Are there specific job roles that are commonly exempt?

Yes, certain job roles are commonly classified as exempt under the FLSA. These include positions like executive managers, professionals (such as attorneys and doctors), and administrative employees who perform tasks that require discretion and independent judgment. Other examples include highly skilled roles in fields such as technology or finance, where the employee’s work is primarily intellectual and paid on a salaried basis. However, exemption status can vary by industry and specific job functions, so it’s essential to look at the regulations that apply to your job category.

What rights do non-exempt workers have regarding overtime pay?

Non-exempt workers have the right to receive overtime pay for any hours worked over 40 in a workweek. According to the FLSA, overtime must be paid at a rate not less than one and a half times the employee’s regular hourly rate. This legal protection ensures that workers are fairly compensated for their extra hours. Additionally, non-exempt employees can seek remedies if they have been denied proper overtime pay, including filing a complaint with the Department of Labor or pursuing legal action against their employer. It’s essential for non-exempt workers to keep accurate records of their work hours to ensure they receive fair compensation.

Can an employer misclassify a worker as exempt or non-exempt?

Yes, misclassification can occur if an employer improperly categorizes a worker as exempt when they should be non-exempt, or vice versa. This often happens when employers do not fully understand the FLSA criteria or when they attempt to classify a worker to save on labor costs related to overtime. Misclassification can lead to severe consequences, including back pay owed to the worker, penalties for the employer, and possible legal disputes. Both workers and employers should educate themselves about the classification standards to avoid these issues, and workers who suspect misclassification should discuss their concerns with HR or legal counsel.

What is the main difference between exempt and non-exempt workers?

The primary difference between exempt and non-exempt workers lies in their eligibility for overtime pay under the Fair Labor Standards Act (FLSA). Exempt workers do not qualify for overtime pay, meaning they are not entitled to additional pay for hours worked beyond the standard 40-hour workweek. Typically, exempt employees are salaried and hold managerial, professional, or administrative positions. In contrast, non-exempt workers are entitled to receive overtime pay, which is usually calculated at one and a half times their regular hourly wage for any hours worked over 40 in a week. This classification is essential for employers to understand, as it impacts labor costs and employee rights.

How can an employee determine if they are classified as exempt or non-exempt?

To determine if an employee is classified as exempt or non-exempt, they should consider several factors related to their job duties and salary. The FLSA outlines specific criteria for exempt status, primarily based on job duties, responsibilities, and salary levels. Employees can check their job description against the criteria set for exempt positions, such as the nature of their work, decision-making authority, and the supervisory duties they perform. Additionally, the employee’s salary must meet a minimum threshold defined by the FLSA. If an employee earns less than this threshold, they are likely classified as non-exempt. It’s also advisable for employees to review their employment contract or discuss their classification with their HR department for clarity, as sometimes specific state laws may apply alongside federal regulations.

What criteria determine whether an employee must be classified as exempt or non-exempt under the Fair Labor Standards Act (FLSA)?

To classify an employee as exempt, several criteria must be considered, including their job duties, salary basis, and whether they earn above the salary threshold. Generally, if an employee is paid on a salary basis and their role meets specific criteria outlined in the FLSA, such as performing executive, administrative, or professional duties, they may be classified as exempt. Conversely, non-exempt employees are entitled to minimum wage and overtime pay based on the number of hours they work.

What is the difference between exempt and non-exempt employees regarding overtime pay?

The primary difference between exempt and non-exempt employees is that non-exempt employees are entitled to overtime pay for hours worked beyond 40 in a workweek, while exempt employees are not entitled to such compensation. This means that if a non-exempt employee works more than 40 hours in a week, they must be compensated at a rate of at least 1.5 times their regular hourly wage, whereas exempt employees typically do not receive additional pay for extra hours worked.

How does the salary threshold for exempt employees affect the classification of workers?

The salary threshold for exempt employees is the minimum salary an employee must earn to qualify for exempt status. As of now, employees earning less than the federal minimum wage or those who do not meet the salary basis requirements are considered non-exempt. Employers must regularly review their payroll practices to ensure that they classify employees as exempt or non-exempt based on the latest FLSA regulations and maintain compliance with applicable labor laws.

What are the implications for non-exempt employees regarding hours worked and overtime compensation?

Non-exempt employees must be paid for every hour they work, including overtime for any hours worked beyond the standard 40 in a week. This includes ensuring that their pay aligns with the federal minimum wage and overtime regulations. Failure to comply with these requirements can result in significant legal and financial consequences for employers, as non-exempt employees are entitled to fair compensation for their labor.

How do employers typically classify highly compensated employees, and what is their status under FLSA?

Highly compensated employees are often classified as exempt employees, provided they meet specific criteria, such as earning above the salary threshold and performing duties that align with the FLSA’s exempt classifications. Employers may also consider the duties of an exempt employee when determining this status. Understanding the key differences between exempt and non-exempt employees helps employers ensure proper classification and compliance with labor laws.