In today’s global marketplace, organizations are often faced with the need to navigate various frameworks that dictate how they present their economic activities. These frameworks provide essential guidelines that help ensure consistency, transparency, and comparability of financial data across different jurisdictions. However, the variance between these systems can lead to significant implications for stakeholders looking to assess a company’s performance.

When looking closely at the two predominant frameworks, one finds a multitude of nuances that influence the way entities classify, measure, and disclose their transactions. Such variances can result in altered interpretations of a company’s true financial condition, potentially affecting investment decisions, regulatory compliance, and strategic planning. Grasping these distinctions is crucial for accountants, auditors, and business leaders who aim for clarity in their financial communications.

Furthermore, as globalization accelerates, the need for harmonization of accounting practices becomes increasingly evident. Understanding the interplay between the two systems not only equips professionals with necessary insights but also fosters better communication in cross-border operations. This examination is essential for anyone involved in the preparation or analysis of financial statements across various platforms.

Understanding GAAP and IFRS Definitions

The frameworks governing the preparation of financial statements play a crucial role in the clarity and consistency of economic information across various jurisdictions. These guidelines ensure that stakeholders, including investors, regulators, and management, can easily interpret and compare the financial health and performance of different entities. A closer look at these standards reveals distinct principles tailored to address the diverse needs of businesses globally.

What is GAAP?

The set of standards primarily used in the United States is known for its structured approach and emphasis on detailed rules. This framework focuses on the specific requirements for financial disclosure, providing a clear roadmap for organizations to follow. Key characteristics include:

- Rule-based guidelines that prescribe exact methods for accounting practices.

- A focus on historical cost measurement, where assets are recorded at their original purchase price.

- Stringent requirements for revenue recognition, ensuring that income is reported only when it is earned.

What is IFRS?

On the other hand, the international standards promote a more principles-based approach, allowing for greater flexibility and interpretation. This framework is designed to accommodate a variety of business environments and economic conditions. Notable features include:

- Principles-based guidelines that provide a broader framework for accounting practices.

- A fair value measurement approach, where assets and liabilities are valued at their current market price.

- A more liberal revenue recognition process, enabling earlier recognition of earnings based on expected performance.

Variations in Revenue Recognition

The approach to acknowledging earnings can significantly change based on the framework being followed, leading to distinct practices and interpretations. Understanding these variations is crucial for stakeholders to assess the economic performance and position of an entity accurately.

Each methodology outlines specific criteria for when income can be recognized. Key stipulations generally involve:

- Timing: The particular moment when revenue is recorded can vary depending on the satisfaction of performance obligations.

- Measurement: The methods used to calculate the amount of revenue also differ, impacting how transactions are valued.

- Contract Modifications: Adjustments to existing agreements can have different implications regarding the timing and amount of revenue recognized.

In practice, entities may adopt various strategies for recognizing income, which can lead to:

- Disparities in reported figures across different organizations.

- Challenges in comparability for investors and analysts.

- Variations in performance analysis and forecasting.

Therefore, it is essential for users of financial statements to recognize these nuances to interpret the results and valuations correctly. Careful examination of the underlying principles will provide deeper insights into company performance.

Asset Valuation Approaches in Standards

Valuation of assets plays a crucial role in the overall assessment and presentation of a company’s worth. Different frameworks have distinct methodologies for determining the value of various assets, influencing the way stakeholders perceive an organization’s financial health. These approaches not only affect the balance sheet but also impact decision-making processes for investors, creditors, and management.

Historical Cost vs. Fair Value

One of the prominent methods involves historical cost, where assets are recorded at their original purchase price. This technique emphasizes reliability but may not fully reflect current market conditions. In contrast, fair value measurement seeks to offer a more accurate representation by estimating the price an asset would fetch in an orderly transaction between market participants. While this approach provides updated insights, it introduces a degree of subjectivity, as it relies on market conditions and assumptions.

Depreciation and Amortization Methods

Another facet of asset valuation concerns the methods used for depreciation and amortization. Various systems exist, such as straight-line, declining balance, and units of production. Each method influences the carrying value of tangible and intangible assets differently over time. The choice of approach can lead to significant variations in reported earnings and asset values, reflecting both the economic reality of asset consumption and management’s strategic decisions.

Lease Accounting: Contrasting Frameworks

In the realm of lease transactions, various accounting systems present distinctive methodologies that significantly influence how obligations and assets are recognized. Understanding these variances is crucial for stakeholders who navigate the complexities of lease agreements. The two prominent standards reflect different philosophies, resulting in alternative treatments for lessees and lessors.

Essential Concepts

- Recognition: Each framework outlines specific criteria for identifying lease assets and liabilities.

- Measurement: Approaches to measuring the value of lease agreements diverge, affecting the balance sheet outcomes.

- Classification: The way leases are categorized influences financial statements, particularly regarding operational versus financial leases.

Implications for Organizations

- Reporting Consistency: Diverging practices lead to inconsistencies in how organizations communicate their leasing activities.

- Decision-Making: Variations can affect investment choices, borrowing capacities, and overall strategic planning.

- Compliance Challenges: Companies must invest resources to ensure adherence to the applicable standards and navigate the complexities involved.

Ultimately, the approach to lease transactions within these two frameworks shapes not only the presentation of the books but also influences operational strategies and investor perceptions.

Implications for International Businesses

In the realm of global commerce, the varying standards for presenting financial performance pose significant challenges and opportunities for enterprises operating across borders. As companies navigate these diverse frameworks, they must consider the implications on their operations, compliance, and overall strategy. Understanding these nuances is essential for maintaining transparency and fostering trust among stakeholders.

Challenges in Compliance

International organizations often encounter complexities when trying to align their financial practices with disparate regulations. The need for continuous training, potential revaluation of assets, and the adjustment of existing financial systems can impose an added burden on resources. Companies must invest in robust processes to ensure conformity with varying requirements, which may lead to increased operational costs and time delays in reporting.

Opportunities for Strategic Adaptation

Conversely, the existence of alternative reporting standards can offer businesses the flexibility to tailor their financial narratives to suit diverse audiences. By strategically adopting frameworks that resonate with their stakeholder base, firms can enhance investor relations and potentially attract more capital. Additionally, the capability to navigate multiple reporting environments can serve as a competitive advantage when entering new markets, positioning businesses for growth in a global landscape.

Future Trends in Financial Reporting

The landscape of corporate disclosure is undergoing significant transformation. As technology advances and regulatory environments evolve, organizations must adapt their practices to meet new expectations. This evolution is driven by a demand for greater transparency, efficiency, and integration of real-time data analysis into disclosure processes.

Technological Integration

Innovations in technology are reshaping how entities prepare and present their financial information. Key aspects include:

- Automation: The increasing use of artificial intelligence and machine learning is streamlining the preparation of reports, reducing the likelihood of errors.

- Real-time Data Access: Cloud computing allows businesses to access financial information quickly, supporting timely decision-making and reporting.

- Blockchain Technology: This offers enhanced security and transparency in transactions, potentially revolutionizing auditing and compliance processes.

Emphasis on Sustainability

More organizations are recognizing the importance of disclosing non-financial indicators alongside traditional metrics. Key elements include:

- Environmental Responsibility: Companies are increasingly expected to report on their environmental impact and sustainability efforts.

- Social Accountability: Stakeholders want to know how businesses address social issues, including diversity and community engagement.

- Governance Factors: Clear communication about governance practices is becoming essential for maintaining trust with investors and regulators.

As businesses navigate this new era of disclosure, they must remain proactive and adaptable to ensure their practices align with emerging trends and stakeholder expectations.

Questions and answers: Gaap vs ifrs

What are the main differences between GAAP and IFRS?

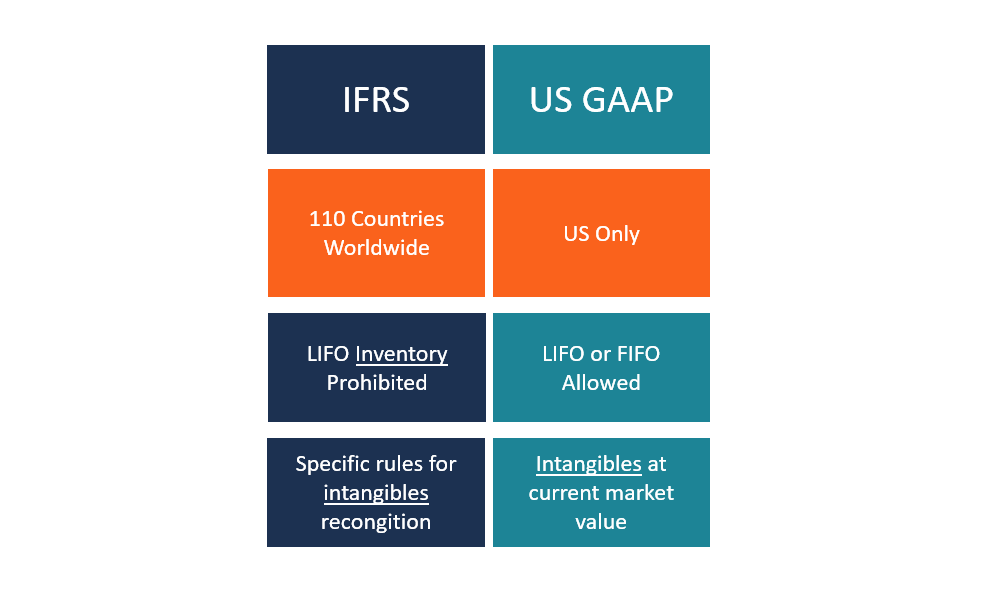

GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) differ in several key areas. Firstly, GAAP is a set of accounting standards primarily used in the United States, while IFRS is used internationally. One of the main differences lies in revenue recognition; GAAP has more specific guidelines, whereas IFRS allows for more judgment in recognizing revenue. Additionally, GAAP uses the last-in, first-out (LIFO) method for inventory, which is not permitted under IFRS. Financial statement presentation also varies, where IFRS requires a statement of changes in equity, which is not mandatory under GAAP. These differences can have significant impacts on financial reporting and comparability across different jurisdictions.

How does the choice between GAAP and IFRS affect a company’s financial statements?

The choice between GAAP and IFRS can lead to significant differences in a company’s financial statements. For instance, under GAAP, companies may report a higher net income due to specific revenue recognition rules, while IFRS could result in more conservative reporting. Additionally, variations in asset valuation methods can affect total assets on the balance sheet, influencing financial ratios such as Return on Assets (ROA) and Debt to Equity ratio. Companies switching from GAAP to IFRS may need to restate prior financial statements to align with IFRS standards, which can affect investor perceptions and financial analysis. Therefore, the choice of accounting standards can shape a company’s financial narrative and impact stakeholder decisions.

What impact does the transition from GAAP to IFRS have on companies?

The transition from GAAP to IFRS can have profound impacts on companies, both operationally and financially. Initially, companies must undertake extensive training for their accounting personnel to understand and implement IFRS standards, which can incur costs. Furthermore, the transition might require altering internal controls, reporting practices, and information systems. Financially, companies could experience significant fluctuations in reported earnings and asset valuations, which may affect stock prices and investor confidence during the transition period. Moreover, embracing IFRS can open up global market opportunities, as it is recognized worldwide, facilitating easier foreign investments and business relationships. Ultimately, while the transition poses challenges, it can enhance transparency and comparability on a global scale.

Are there any countries that still strictly use GAAP instead of IFRS?

Yes, the United States is the most notable country that strictly uses GAAP instead of IFRS. The U.S. has its own unique set of accounting standards governed by the Financial Accounting Standards Board (FASB), which differs significantly from IFRS. While there has been discussion around the convergence of GAAP and IFRS to create a more unified accounting framework globally, as of now, the U.S. continues to use GAAP for public and private entities. Some companies in the U.S. may choose to report under IFRS in their foreign operations or subsidiaries, but the majority of companies report solely under GAAP for their domestic operations.

What importance do GAAP and IFRS hold for investors and stakeholders?

GAAP and IFRS are crucial for investors and stakeholders as they provide the framework for the preparation of financial statements, influencing investment decisions and financial analysis. Investors rely on these standards for transparency and consistency in financial reporting, facilitating comparability across companies and industries. Compliance with GAAP or IFRS indicates that a company adheres to established accounting principles, which can mitigate risks and enhance credibility in the eyes of stakeholders. Moreover, understanding the differences between these frameworks is essential for multinational investors who need to evaluate a company’s performance adequately. Accurate and reliable financial reporting bolstered by recognized standards like GAAP and IFRS plays a vital role in fostering trust and informing capital allocation decisions.

What are the key differences between IFRS and US GAAP in terms of accounting principles?

The key difference between IFRS and US GAAP lies in their approach to accounting principles. IFRS is principles-based, allowing for more interpretation and flexibility, while US GAAP is rules-based, meaning it follows strict guidelines for financial reporting. This distinction often leads to differences in how companies report financial information, such as revenue recognition, inventory valuation, and fixed assets.

How does IFRS handle the capitalization of development costs compared to US GAAP?

Under IFRS, companies are allowed to capitalize development costs as long as certain criteria are met, meaning these costs can be recorded as assets. US GAAP, on the other hand, generally requires development costs to be expensed as incurred. This is a key difference between the two standards, impacting how companies report their research and development activities on their income statement and balance sheet.

What are the main differences in inventory valuation between IFRS and US GAAP?

IFRS prohibits the use of the Last In, First Out (LIFO) method for inventory valuation, allowing only the First In, First Out (FIFO) or weighted average cost methods. In contrast, US GAAP permits companies to use the LIFO method for inventory valuation. This difference can result in varying profit margins and tax liabilities for companies using one standard over the other, especially during periods of inflation.

How do the cash flow statement requirements differ between IFRS and US GAAP?

While both IFRS and US GAAP require companies to report cash flow statements, there are differences in classification. IFRS allows more flexibility in classifying interest and dividends, where companies can report interest paid either as an operating or financing activity and interest received as either an operating or investing activity. US GAAP is more prescriptive, requiring interest paid and received to be classified under operating activities. These differences can affect how cash flows are presented and interpreted.

Why might some US companies adopt IFRS instead of GAAP?

US companies that operate internationally or are listed on foreign stock exchanges may adopt IFRS to align with global accounting standards. Since IFRS is used by over 110 countries and issued by the International Accounting Standards Board (IASB), it may provide greater comparability for companies with international operations. Additionally, the principles-based nature of IFRS can offer more flexibility compared to the rules-based approach of US GAAP.