The distinction between total income and what ultimately lands in one’s bank account is often a source of confusion. Many individuals may find themselves bewildered when trying to comprehend the proportions that constitute their financial compensation. This topic sheds light on the aspects that contribute to the figures seen on paycheck stubs, offering clarity in a realm filled with numbers and deductions.

At the core of this discussion lies the recognition that not all monetary rewards are equivalent. While the sum initially promised to an employee may seem substantial, various factors come into play that influence the final sum received. Taxes, benefits, and other deductions drastically shape the economic reality of one’s financial landscape, compelling a deeper examination of these elements.

By dissecting these two components, individuals can equip themselves with the necessary knowledge to navigate their fiscal responsibilities and expectations. A clearer grasp of how earnings transform into disposable funds empowers people to budget, plan for the future, and make informed decisions regarding their financial well-being.

What is Gross Pay?

The initial amount earned before any deductions are made represents a crucial aspect of an individual’s financial profile. It encompasses various forms of compensation, reflecting the total earnings prior to the subtraction of taxes and other contributions. This figure serves as a foundational element in determining overall financial health.

Components of Gross Earnings

A variety of factors contribute to the total sum an employee receives. These can include base salary, overtime, bonuses, and commissions. Understanding the different sources of compensation can provide clarity on the overall earnings structure.

| Component | Description |

|---|---|

| Base Salary | The fixed annual amount agreed upon between the employee and employer. |

| Overtime | Additional compensation for hours worked beyond the standard workweek. |

| Bonuses | Extra payments awarded for meeting certain performance goals or milestones. |

| Commissions | Compensation based on sales or specific business achievements. |

The Importance of Understanding Total Compensation

Knowing the complete amount earned helps individuals better plan their finances, budget effectively, and make informed decisions regarding savings and investments. It also lays the groundwork for grasping the impact of various deductions on the resulting take-home amount.

Defining Net Pay Explained

The amount an employee ultimately receives after all deductions is crucial for financial planning and personal budgeting. Understanding this figure helps individuals assess their actual earnings and manage their expenses effectively. This section delves into the key attributes of this essential financial concept, providing clarity on its significance in the world of employment.

Components and Deductions

Several factors contribute to arriving at the final monetary figure received by employees. The following elements play a significant role:

- Mandatory taxes, including federal, state, and local withholdings

- Social Security contributions

- Health insurance premiums

- Retirement plan contributions

- Other optional deductions, such as life insurance or union dues

Importance for Financial Health

Recognizing the distinction between initial earnings and the final sum deposited in bank accounts can lead to better financial decisions. Here are some benefits of being aware of this crucial figure:

- Assisting in budgeting and personal finance management

- Facilitating informed decisions regarding spending and saving

- Helping in loan applications and financial planning

- Allowing individuals to gauge their effective compensation

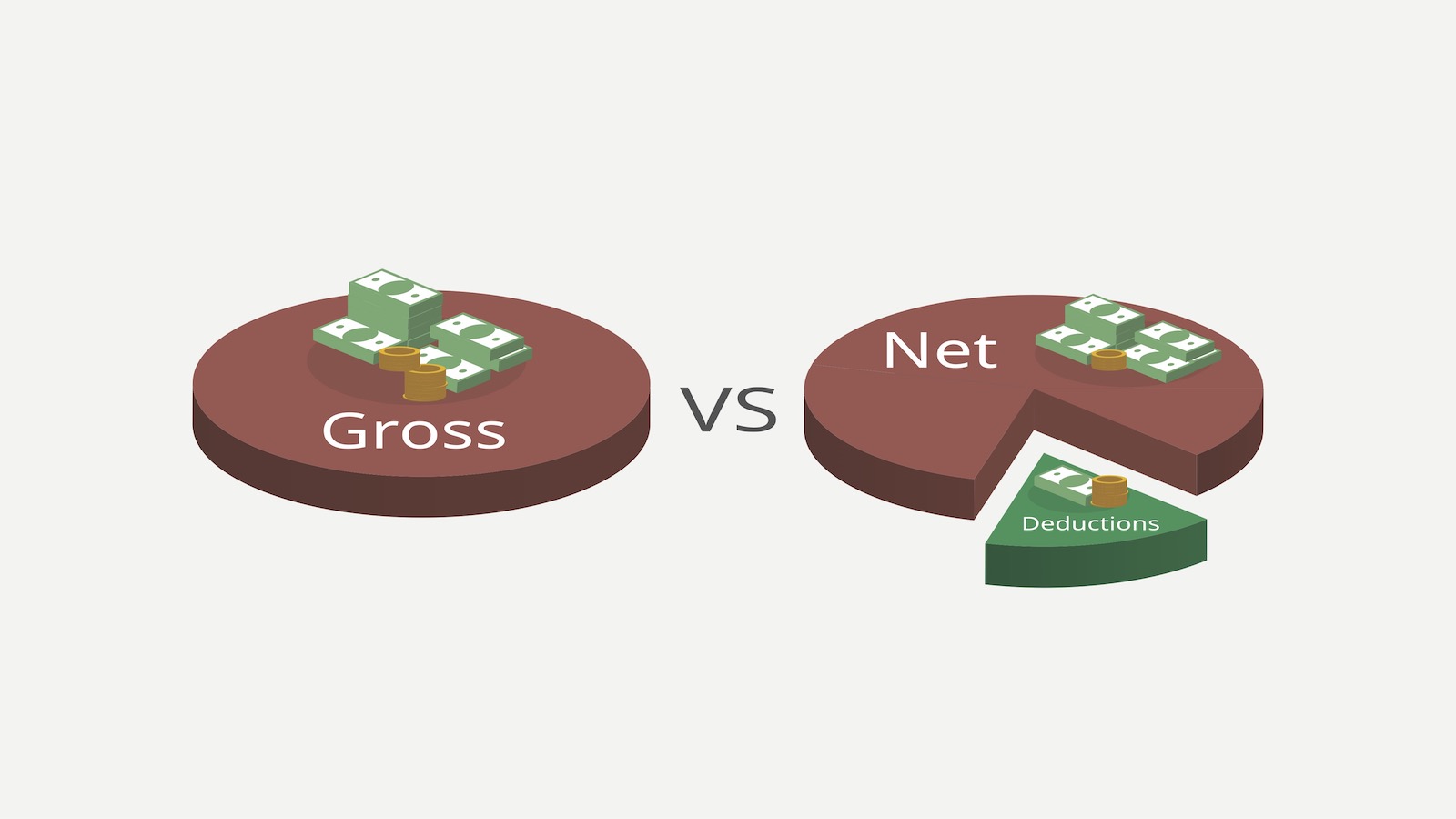

Key Differences Between Gross and Net Pay

When discussing earnings, it is crucial to differentiate between the total amount received before deductions and the actual amount deposited into your account after all mandatory and voluntary subtractions. Understanding this distinction can help individuals better manage their finances and plan for their financial future.

Definition and Calculation

The initial figure reflects all earnings for a given period, including wages, bonuses, and overtime. On the other hand, the final amount is what an employee takes home after taxes and other deductions are applied.

- Total Earnings: This encompasses all forms of compensation.

- Deductions: These may include federal and state taxes, social security contributions, healthcare premiums, and retirement plan contributions.

Impact on Financial Planning

Being aware of both figures is essential for effective budgeting and financial decision-making. Here are some key aspects to consider:

- Knowing your total compensation allows for better assessments of job offers and salary negotiations.

- Focusing on the take-home sum helps in planning monthly expenses accurately.

- Discrepancies between the two amounts can affect long-term savings strategies and investment decisions.

Factors Affecting Your Take-home Salary

Your final earnings are influenced by various elements beyond the base amount you receive for your work. These components can significantly impact the amount that ultimately ends up in your bank account each payment period. Understanding these factors is crucial for better financial planning and optimizing your economic situation.

- Tax Obligations: The level of income tax you are subject to can greatly reduce your final amount. Different tax brackets and local tax regulations play a significant role.

- Benefits and Deductions: Contributions to retirement plans, health insurance, and other employee benefits are commonly subtracted from your earnings, influencing the total that you actually receive.

- Employment Type: The nature of your employment, whether full-time, part-time, or freelance, can determine how deductions and taxes are handled, thus affecting your final sum.

- State and Local Taxes: Depending on where you reside, additional taxes imposed by state or local governments may also impact the amount you retain.

- Overtime and Bonuses: Extra hours worked or bonuses awarded can increase your overall compensation, but they may also elevate your tax bracket, affecting how much you ultimately take home.

Being aware of these elements allows individuals to make informed choices regarding job offers, benefits enrollment, and overall financial strategy.

How Taxes Impact Your Earnings

Taxes play a crucial role in the overall financial landscape of individuals. They are mandatory contributions imposed by the government, which can significantly alter the amount of money individuals actually receive from their earnings. Understanding how these deductions function is essential for effective financial planning and budgeting.

When income is earned, a portion is typically withheld for various tax obligations, including federal, state, and sometimes local taxes. This withholding can vary based on several factors, such as the individual’s income level, filing status, and eligible deductions. These withholdings reduce the amount available for personal use and can influence overall financial stability.

Additionally, different types of income may be subject to distinct tax rates. For example, wages, bonuses, and investment income might each face different treatment under tax law. This variability emphasizes the importance of familiarizing oneself with tax regulations to maximize retained earnings. Furthermore, some individuals may qualify for tax credits or deductions, which can mitigate their tax burden, leading to higher retained amounts from their earnings.

Ultimately, being knowledgeable about how taxes affect financial outcomes allows individuals to make informed decisions regarding their finances, helping them achieve their financial goals more effectively.

Understanding Deductions and Withholdings

Deductions and withholdings play a crucial role in the financial landscape of an individual’s earnings. These adjustments can significantly influence the amount that ultimately ends up in a person’s bank account after all calculations are completed. Grasping the nature and function of these subtractions is vital for anyone managing their budget and planning for future expenses.

Deductions typically refer to amounts subtracted directly from an employee’s paycheck. These can encompass items like retirement contributions, health insurance premiums, and various benefits. Each deduction can have a direct impact on overall financial health, making it essential to be aware of them and how they are structured.

Withholdings, on the other hand, involve amounts taken out to fulfill tax obligations. These withholdings are typically based on an individual’s estimated tax liability and can vary depending on numerous factors, including income level and personal circumstances. Understanding the mechanics of these withholdings can empower individuals to make informed decisions regarding their finances.

Questions and answers: Gross pay vs net pay

What is gross pay and how is it calculated?

Gross pay is the total amount of income earned by an employee before any deductions or taxes are applied. It includes wages, bonuses, overtime pay, and any other forms of compensation. Gross pay is typically calculated based on the employee’s hourly wage or salary, multiplied by the number of hours worked or the pay period. For example, if you earn $20 per hour and work 40 hours a week, your gross pay for that week would be $800.

What is net pay and what factors affect it?

Net pay is the amount of money that an employee takes home after all deductions have been made from their gross pay. These deductions can include federal and state taxes, Social Security and Medicare contributions, retirement plan contributions, health insurance premiums, and any other voluntary or mandatory deductions. Factors that affect net pay include changes in tax rates, the number of dependents claimed, benefits chosen, and any additional withholdings an employee may opt for. Because these factors can vary widely from person to person, net pay can differ significantly even among employees with similar gross pay.

Why is it important to understand the difference between gross pay and net pay?

Understanding the difference between gross pay and net pay is crucial for personal financial planning. Knowing how much money you will actually take home (net pay) helps you create a realistic budget, manage expenses, and plan for savings or debt repayments. It also ensures that you are aware of your total earnings (gross pay) and the various deductions that affect your take-home amount. This knowledge can help prevent surprises when you receive your paycheck and assists in making informed decisions about employment offers, benefit selections, and tax strategies.

How do taxes influence gross pay and net pay?

Taxes have a direct impact on net pay, as they are deducted from gross pay to arrive at the final amount an employee receives. Federal, state, and local taxes vary depending on where you live and your income level. The more you earn (gross pay), the more you may pay in taxes, as tax brackets are progressive. Additionally, tax deductions and credits can also influence how much gets withheld, affecting your net pay. Understanding your tax obligations allows you to have a clearer picture of how much of your gross income will actually be available to you.

What should I consider when negotiating my salary regarding gross and net pay?

When negotiating your salary, it’s vital to consider both gross pay and net pay. Start by focusing on the gross salary being offered, as it’s the figure that represents your overall compensation before deductions. However, also consider how deductions might impact your take-home pay (net pay). Understand the tax implications and any benefits that come with the job, such as health insurance, retirement contributions, or other perks that could affect your overall compensation package. This holistic view allows you to negotiate more effectively and ensure that your financial needs are met.

What is the difference between gross pay and net pay?

Gross pay refers to the total amount of money earned by an employee before any deductions are taken out, such as taxes, social security, health insurance, and retirement contributions. It includes wages, salaries, bonuses, and any other forms of compensation. On the other hand, net pay is the amount of money an employee takes home after all deductions have been applied. Essentially, while gross pay shows the overall earnings, net pay reflects the actual income available for personal expenditures.

Why is it important to understand both gross pay and net pay?

Understanding both gross pay and net pay is crucial for several reasons. First, it helps employees realistically plan their personal budgets and financial commitments based on their actual take-home pay, rather than just the total earnings. Secondly, it enables individuals to better understand their paychecks and the various deductions that are taken out, such as income tax and health benefits. This understanding can also pave the way for informed discussions with employers regarding salary negotiations and benefits. Additionally, knowing the difference is vital for tax preparation since individuals need to account for gross income when determining tax liabilities. Overall, this knowledge contributes to better financial literacy and empowers employees to make informed decisions regarding their finances.

What is the difference between gross pay and net pay?

Gross pay is the amount an employee earns before any payroll deductions, such as federal income tax, payroll tax, state income tax, and medicare tax. Net pay, on the other hand, is the amount the employee takes home after these deductions. Net pay calculations account for all withholdings subtracted from their gross pay to determine the employee’s take-home pay.

How do you calculate gross pay for an hourly employee?

To calculate gross pay for an hourly employee, multiply the number of hours worked during the pay period by the employee’s hourly pay rate. For example, if an employee works 80 hours per pay period at $15 per hour, the gross pay amount would be 80 x $15, totaling $1,200.

What deductions are taken from gross pay to determine net pay?

Deductions from gross pay include federal income tax, FICA tax (which includes social security and medicare tax), state income tax, and potentially local income tax, depending on where the employee works. These deductions from their gross pay reduce the amount the employee takes home, resulting in their net pay.

How is an employee’s annual salary calculated if they are paid biweekly?

An employee’s annual salary can be calculated by taking their gross pay per pay period and multiplying it by the number of pay periods per year. For biweekly pay, there are typically 26 pay periods in a year. For example, if an employee’s gross pay per pay period is $2,000, the annual gross income would be $2,000 x 26, which equals $52,000.

What information is provided on an employee’s pay stub?

An employee’s pay stub shows various details of their pay, including the gross pay amount, net pay amount, payroll deductions (such as federal and state income taxes, payroll tax, and medicare tax), and taxable income. It helps employees understand the difference between their gross wages and net income, as well as specific deductions subtracted from their gross pay to calculate the take-home pay.